Creating and honing your craft. Whatever it is you do, do it to the absolute best of your abilities. Do it so others smile while observing you in action working on whatever it is you do. We have all done it. We've observed the amazing waiter or waitress working their craft doing an amazing job, and we've all witnessed others not doing a good job and thinking to ourselves why are they here - why are they serving others because it's obvious they do not want to be here or do not care about being the best at their craft. Whatever it is you do, work at being the best you can be. All jobs are important at every level and are an expression of who you are and what you value. Ideally, we should all be working on something we get great joy out of and are passionate about. However, if you feel like you are not doing what you want and you aspire to be more, that's OK. Be patient, but most importantly, be the best at whatever it is you are doing right now. Want a promotion or a job change because you feel like you were meant for more or you deserve it? I can almost guarantee you, that if you work on your craft tirelessly so others see how good and how much you care about helping others, the promotion or new job opportunity will present itself. Spend less time being dissatisfied and spend more time focused on how you can improve yourself at work and home to create more value for others. Others will soon notice, and there is a high probability, you will either be promoted to the next position or you will create the next position for yourself in the very near future. Here at Frontier Property Mgmt, LLC - our goal is to help 1,000 people become financially free by passive real estate investing and investing in business ventures that are tied to the operator's strengths, talents, gifts and abilities. Further, we want to create an amazing and memorable living experience for 1,000,000 residents that we or our investor clients manage for. If we help more investors be great, they in turn will be able to help more residents get the most out of their living experience.

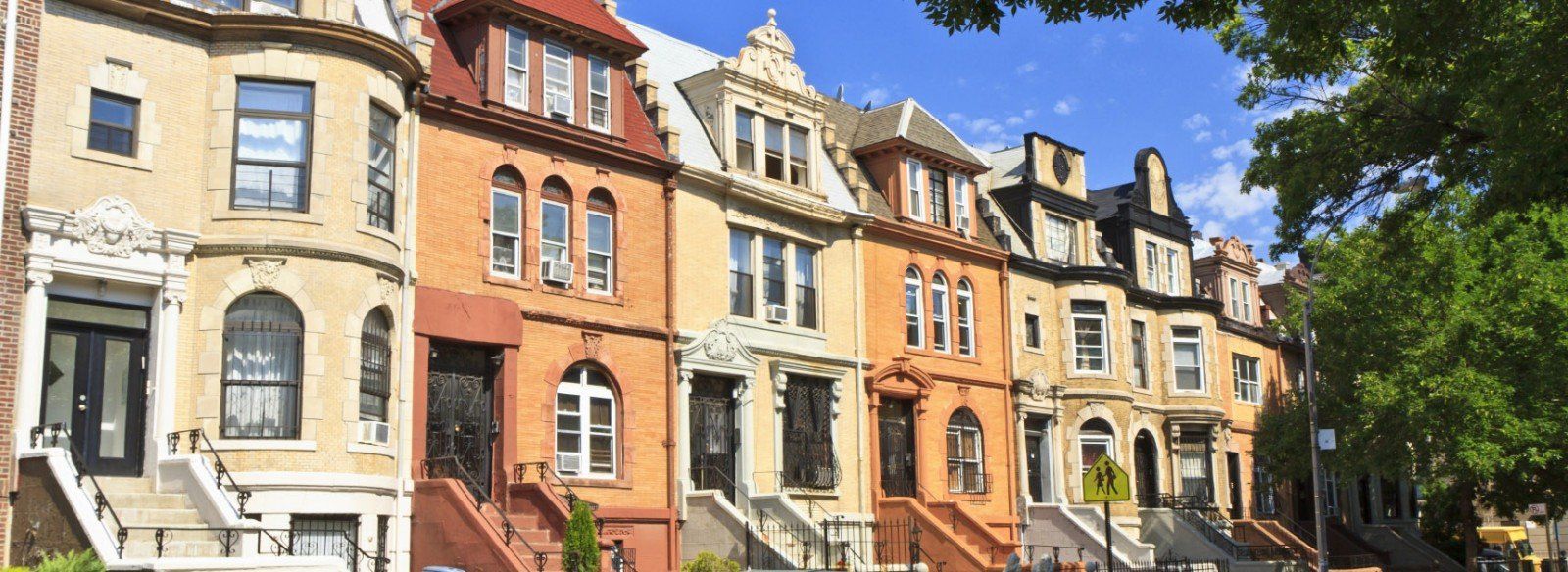

Early in my real estate investing career, I have to admit, I would buy property in almost any location - wherever the numbers made sense" - despite what the "feel of the location" felt like. I would often overlook the feel of the home in favor of the numbers. I figured, even if I did not like the looks or the feel of the location, I was not going to live there, and the outstanding proforma on paper would solve it all right? Problem was, that proforma with how it SHOULD perform meant almost nothing with how it ACTUALLY performed. Oftentimes, the properties I feared I paid too much for (had a much lower cap rate) were actually oftentimes some of the best performers in real dollars. Now I realize this is a general assessment, and is not always the case, especially since properties can be repositioned, but today with this blog post, I want to make the case for putting the "look and the feel of the location" primary versus simply buying where "the numbers make sense". Why is it so important to care about the look and "feel of the location" - afterall, isn't real estate investing all about the numbers? Real estate investing IS all about the numbers, but its all about the REAL numbers! So, how do you cut the risk? It's simple: Buy properties (the physical assets) in locations (neighborhoods and streets) where people want to live, have the capacity to pay, and are proud to call "HOME". That's why, when contemplating new property investments, spend time out front, walk the grounds, and THINK. Thinking about why people would want to live here and what makes the home unique or desirable. IF tenants are looking for a place they are proud to call HOME, what exactly makes a property HOME to them? For almost every tenant I, or any member of our team has ever met in this business over the last 11 years (probably thousands of people at this point), most would tell you they are looking for many of the same things. They say, they VALUE - safety, organization and order, prettiness (aesthetics is too complicated of a word for me), clean and well kept within a reasonable distance to where they work, shop and like to go and a place they are proud to bring friends and family. Also, they don't want to have to drive by or through places they personally find to be undesirable to get to their home. So, as you are debating a new real estate investment, pay attention to how the numbers look on paper, making sure they fit your minimum investment criteria, but after they meet that, spend a good amount of time thinking about some of these things mentioned above and please have someone you trust physically drive the location for their opinion so that it validates or disqualifies what you are seeing. Once you do your research, you like the numbers, and have the physical drive by validation, it's time to add another investment! Folks want to live in places they love to call home - and believe me, they will be thinking about this each and every time they mail off (or electronically send) their rent to you. They are paying for value - so think about what they value and do yourself an investment favor, buy where people want to live. The hard part is finding the asset..but once a great asset is purchased, let the market and sound property mgmt operations (like what Frontier offers) be the icing on the cake. It's almost a sure thing: If you buy a great asset in a location people WANT to live and have a good property manager to deliver the service, there is no better investment than rental real estate! So, if you are looking for a team that understands this business and loves operations, give us a call. We are 15 people strong! Be happy to talk through and drive by any asset you are serious about buying or already have under contract. Congratulations on your investment into this business! Real estate is awesome in so many ways! Chad

What I've learned over the years and what I am still learning. I still have so much to learn that's for sure and it's fun to try and get better everyday and I am sure you are the same. I'd like to share a few things I've learned. First off. Lets identify what I've been doing over the years. I invest in real estate and manage property. Started investing in 2009 in the midst of the great recession about 30 days after a layoff that I thought would never happen - but thankful now that it did. Prior to real estate I was in sales for Hershey foods for about 4 years then did commercial financing for General Electric in their Capital group. First in inside sales then, their Commercial Leadership Program then as Regional Manager overseeing the central part of the US selling financing to the Refuse Industry - trash trucks and waste equipment! A fun job and industry to learn. The layoff was tough at the time, but a blessing. In January 2009 I purchased a $15K single family home about 11 miles east of where I grew up and we've not stopped since then. I still remember that rehab like it was yesterday. My wife Jessica and my parents and I rehabbed the house and rented in for about $500 per month. At the time, I never dreamed this business would turn into so many houses and so much fun. From that little house in Louisiana MO, we moved to a four plex in Bowling Green Mo where I grew up then to St. Louis where I was living at the time. In St. Louis, I hooked up with a few good brokers and the race was on to buy foreclosure properties from banks and motivated sellers. I think back to those days in South City when almost no one was buying it seemed like and Tower Grove Park area was yielding 15% cap rates all day long!! Can you believe that. We were buying amazing four family buildings with 2 bedroom units for about $150K that would rent for $750 per unit that now rent for about $1,300 all day. Needless to say, properties like these created the ideal buy, rehab, rent and refinance strategy even before it was a strategy that is so widely popular today that you all know. I won't even name it because it seems every real estate investor talks or writes about it today. I guess the reason they do is because the buy, fix, rent and refi strategy is so amazing. Banks love it, and I love it too. It's what keeps a full time investor like me in business. Sure, I have loans on about everything, but I've also purchased a great deal of property with just a rather small initial investment. Same goes for the few partners I work with. I guess I'll be Ok as long as the market does not take a 35%+ dive and all tenants don't pay. It could happen, but it's a necessary risk in this business if you want to use the same capital over and over to grow units, revenue and net worth. That's my business background since college for the most part. Besides growing a rental portfolio, we also manage buildings for others which is an awesome job. I love helping others with their assets and especially doing a good job so they can buy more units and get closer to the goals they have. Ok, so that's my background. Looking back, what do I think are some of the most important things to know or do in real estate? Profit First (the book) - how I use the book's strategy. Pay yourself first. Allocate the first 8% or so of revenue to your profit account which is paid before any expenses, then about 4% to capital reserves, pay property taxes monthly to the collector of revenue and the rest to the checking account to grow for uncertainties or other investments. At one time, I had about 4 bank accounts per LLC, and we have a lot of LLC's, but I found that was too many and quite frankly, sometimes there was not enough to fill all the buckets, since this business can be pretty low margin. Generally, if we can generate about 15 to 20% profit on rent after paying all expenses, that's amazing. When underwriting new deals, generally I allocate about 8% to vacancy, 35% for mortgages, 40% for expenses and hope for about 15 to 20% profit on revenue. In my experience, whether it's a single family home or 78 unit building, the profit margins are about the same. So that's why over the years I've gravitated from SFR to multifamily since with a multifamily acquisition you can get so much more revenue in the door each month. I don't see them as any more risky than SFR and I really like the upside and amount of equity you can build. Same equity percentages, just a lot more of it ($) with multifamily with each purchase. In the coming weeks, I will write about a few other topics.. little teaser below on some of the topics..as if you were hanging on my every word! I will write a few things about what I've learned so maybe it's helpful and maybe it's not, but you never know until you try so I'll do that soon in the coming days or weeks. -Buy properties where people want to live - no matter what the proforma looks like -Once you buy the property, make your tenants proud of the inside and outside of their apt -Manage what matters - occupancy, collections and maintenance as a % of revenue. -Simply, treat other people like you want to be treated - listen, communicate and follow through Talk soon. Feel free to contact myself at chad@314rent.com or leave a comment if you have questions on a topic or find this content helpful. Chad